Social Security And Medicare Limits 2025

Social Security And Medicare Limits 2025. So, the ssa looks at your 2025 tax. What are the changes to medicare in 2025?

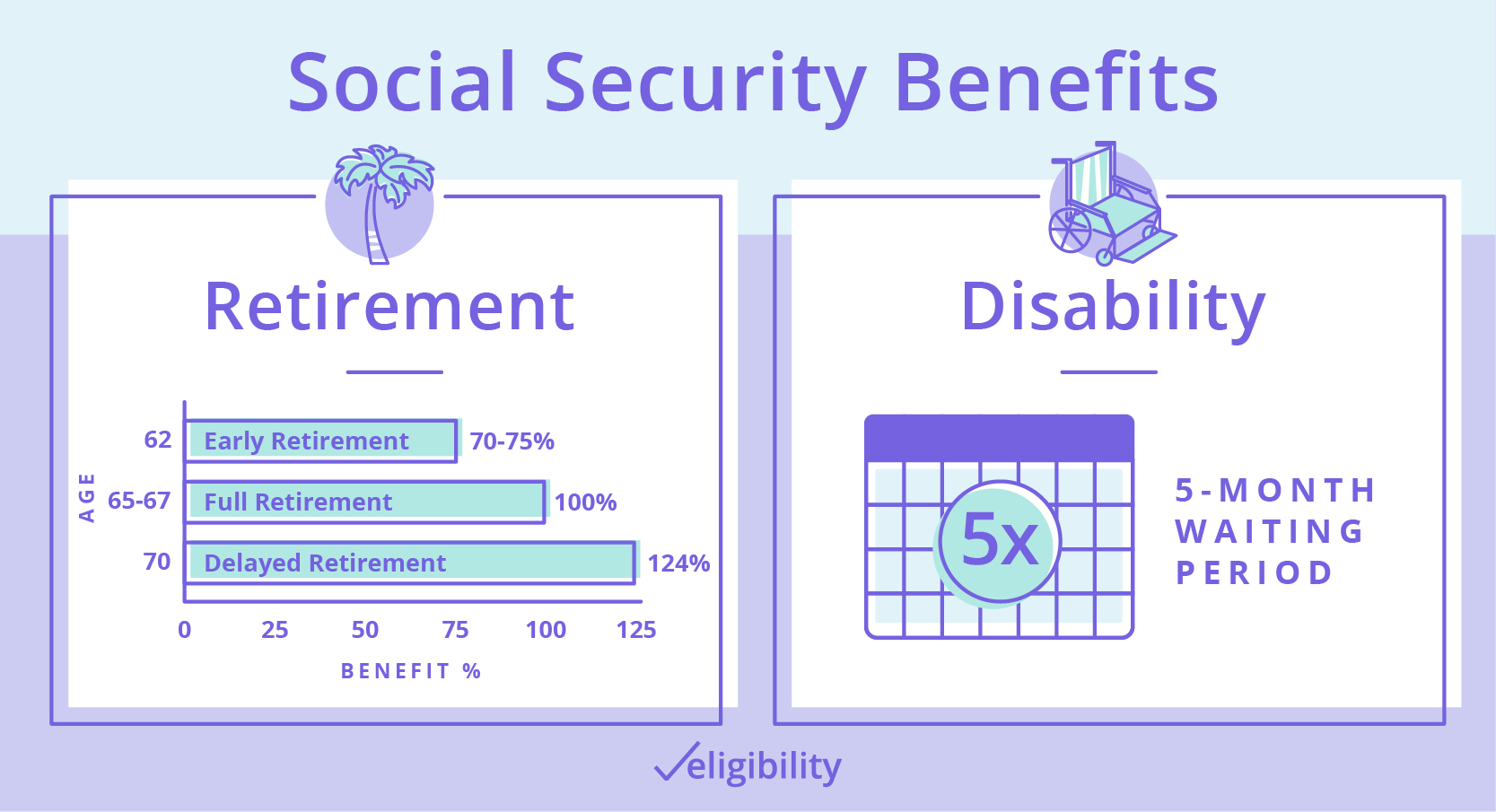

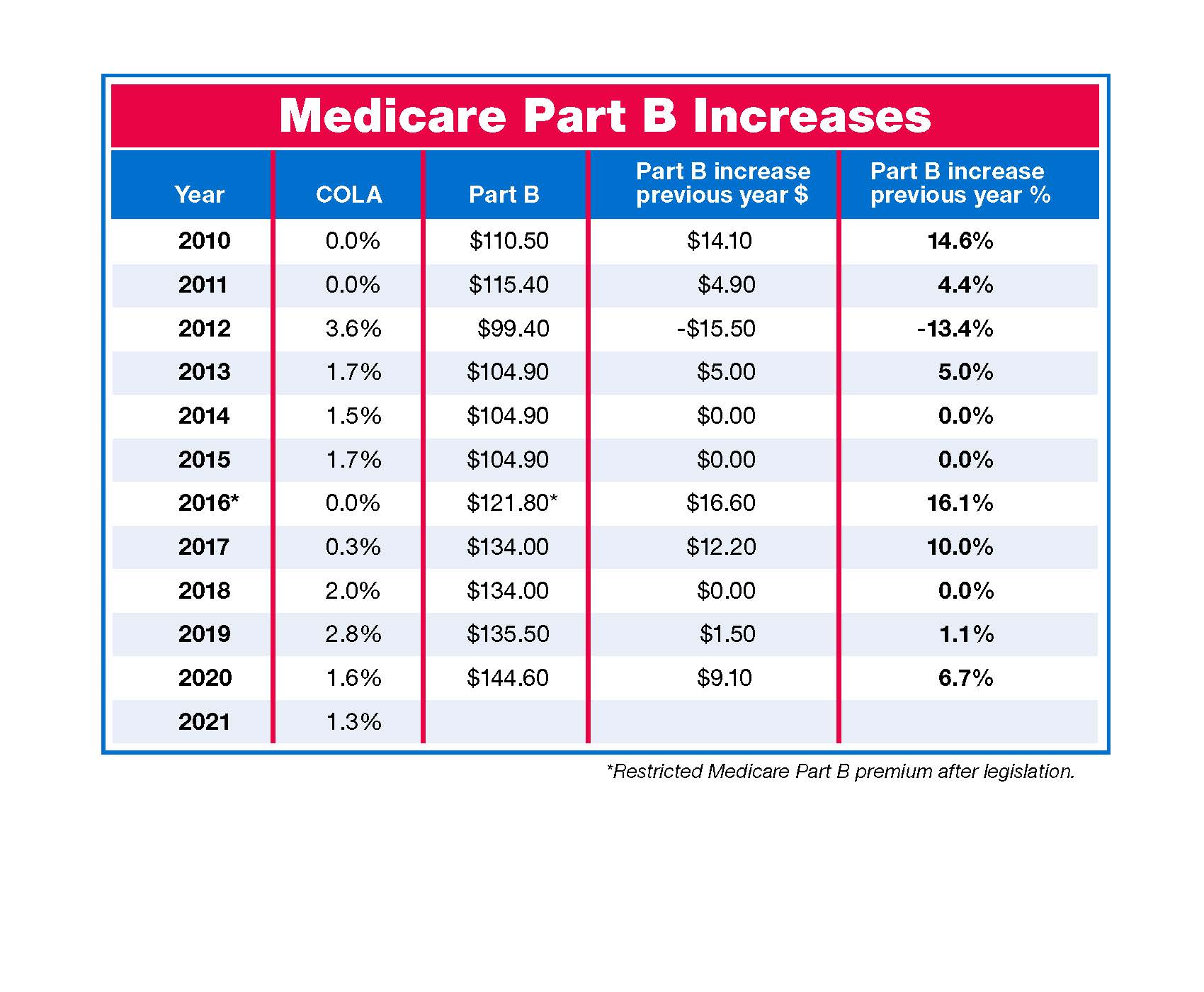

Irmaa is an extra fee that you pay on top of your medicare part b and d rates if you earn above a certain threshold. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

The social security administration (ssa) determines who pays an irmaa based on the income reported two years prior.

When Are You Eligible For Medicare If You Are Born In 1966, That limit is the maximum amount of income that counts toward computing your social security benefit for the year. People who earn over $97,000 ($103,000 in.

Social Security Error Leads to Unpaid Medicare Coverage, 2025 2025 2026 medicare part b irmaa premium magi brackets. In 2025, the standard part b monthly premium is $174.70.

How Much Is Medicare Part B 2025, Medicare part b supplementary medical. Generally, this information is from a tax.

How Medicare and Social Security Work Together Eligibility, To receive any of the maximum. In 2025, the standard part b monthly premium is $174.70.

Opinion Biden’s Promises on Social Security and Medicare Have No Basis in Reality The New, Information about medicare changes for 2025 will be available at www.medicare.gov. In 2025, for example, the limit is $168,600.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, That limit is the maximum amount of income that counts toward computing your social security benefit for the year. People who earn over $97,000 ($103,000 in.

FAQs about Medicare Medicare Insurance Mesa, AZ Roman Brokers Insurance, Understanding gross versus adjusted incomes matters. That limit is the maximum amount of income that counts toward computing your social security benefit for the year.

Medicare IDs Will No Longer Include Social Security Numbers, Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. For 2025, the monthly medicare part a hospital insurance base premium is $505, and the 45 percent reduced premium is $278.

If Social Security is slashed, seniors like me will end up homeless • Arkansas Advocate, Information about medicare changes for 2025 will be available at www.medicare.gov. Medicare part b and part d prescription drug coverage for year 2025 irmaa tables.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age, In 2025, the standard part b monthly premium is $174.70. To receive any of the maximum.